Accrual and Cash Accounting in QuickBooks

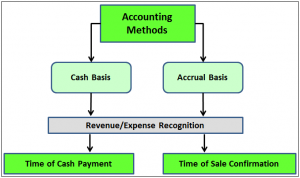

QuickBooks is designed to handle both accrual and cash basis accounting methods. The default setting in QuickBooks is accrual accounting. An example of accrual accounting is entering bill and invoicing transactions that generate Accounts Payable/Accounts Receivable reports. The cash basis transactions in QuickBooks are sales receipts for customers and write check and credit card charges for vendor transactions. Journal entries will always show on both methods and, therefore, should not be used for daily transactions.

handle both accrual and cash basis accounting methods. The default setting in QuickBooks is accrual accounting. An example of accrual accounting is entering bill and invoicing transactions that generate Accounts Payable/Accounts Receivable reports. The cash basis transactions in QuickBooks are sales receipts for customers and write check and credit card charges for vendor transactions. Journal entries will always show on both methods and, therefore, should not be used for daily transactions.

By keeping the accounting method unchanged on accrual basis throughout the year it organizes businesses by being able to review upcoming payables and receivables, most importantly, staying on top of collections. Individual reports can then be changed for accounting method to simply review the difference or if it is a requirement at tax time. It should be noted that only summary reports can be on cash or accrual basis. These are reports that summarize groups of transactions and have the title “Summary”. Detailed reports list individual transactions. These reports always default to accrual basis and cannot be changed to cash basis. If desired, a global preference can be set to change the default setting from accrual to cash basis for summary reports.

For Q uickBooks Desktop to change the accounting method to cash on a summary report:

uickBooks Desktop to change the accounting method to cash on a summary report:

- Customize Reports > cash

For QuickBooks Online to change the accounting method to cash on a summary report:

- Customize > Accounting Method > Cash Basis

For QuickBooks Desktop to change the default setting for accounting method on summary reports:

- Log in as administrator and switch to single user mode.

- > Edit >Preferences

- >Reports & Graphs > Company Preferences

- In the Summary Report Basis section, click: > Cash radio button for Cash or Accrual radio button for Accrual

- Click OK

For QuickBooks Online to change the default setting for accounting method on summary reports:

- Gear icon > Company Settings (or Account and Settings depending on what you see).

- > Company (if Account and Settings, click Advanced)

- > Accounting method

- Choose accounting method

- Click Save & Done.